us japan tax treaty withholding rate

7 Article 10 Dividends in the Japan-US Income Tax Treaty. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2 Saving Clause in the Japan-US Tax Treaty.

. 5 Article 5 Permanent Establishment in the Japan-US Income Tax Treaty. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of. 1 US Japan Tax Treaty.

96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties. Protocol PDF - 2003. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

8 Article 11 Interest in the Japan-US Income Tax Treaty. 6 Article 6 Real Property in the Japan-US Income Tax Treaty. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013.

Interest in excess of the arms length rate may be taxed at source at the rate not exceeding 5. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for dividends paid if the beneficial owner of the dividend is a company that has owned directly or indirectly greater than 50 percent of the voting stock of the. Technical Explanation PDF - 2003.

4 Saving Clause Exemptions. Income Tax Treaty PDF- 2003. This article discusses the implications of the United States- Japan Income Tax Treaty.

Been outside the scope of the dividend.

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

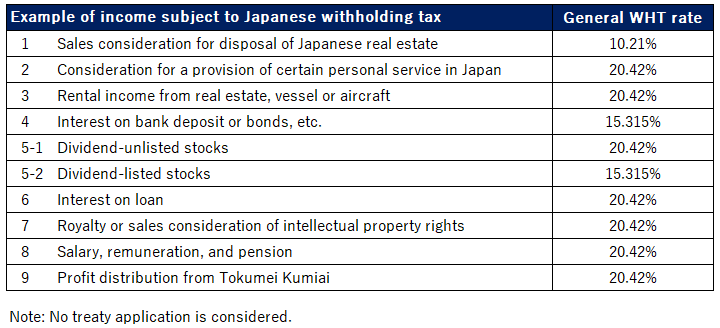

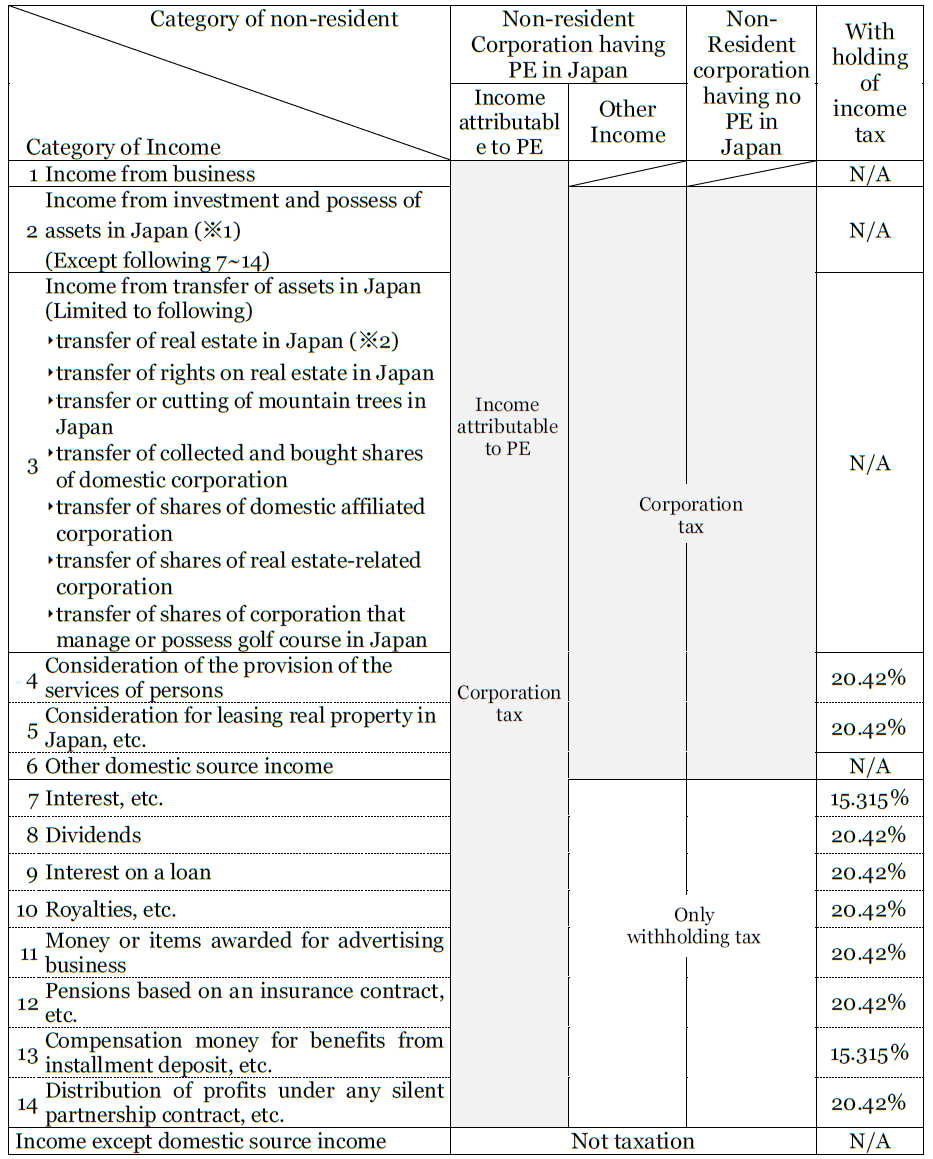

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Form W 8ben Definition Purpose And Instructions Tipalti

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Withholding Tax For The Leasing Of Real Estate Owned By Non Residents Plaza Homes

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

How To Save U S Taxes For Nonresident Aliens

Zim Dividend Tax Treatment How To Get More R Vitards

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Doing Business In The United States Federal Tax Issues Pwc

Step By Step Document For Withholding Tax Configuration Sap Blogs

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Withholding Tax Relief Ppt Download

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog